This isn’t funding recommendation. The creator has no place in any of the shares talked about. Wccftech.com has a Disclosure and Ethics Coverage.

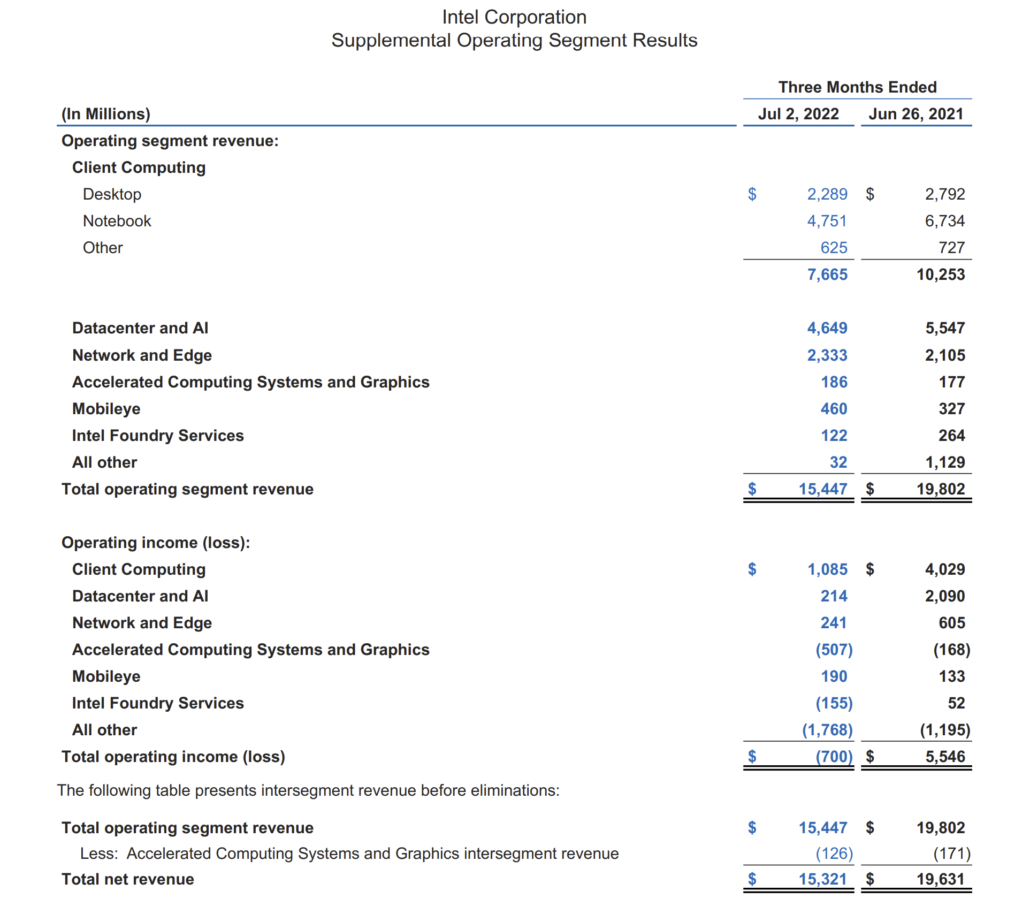

After releasing its second-quarter fiscal 2022 earnings report earlier this week, chipmaker Intel Company is receiving hard-hitting analyst protection from a number of firms. of Wall Avenue. Intel’s newest outcomes noticed the corporate’s income and internet revenue fall 22% and 109% respectively, with its administration attributing the weak income to the present financial downturn and the online loss to enterprise bills. excessive funding because it seeks to regain technological management in chip manufacturing processes. and set up a strong footing within the contract chip manufacturing trade.

After the earnings, Wall Avenue analysts virtually unanimously downgraded Intel’s inventory value targets and launched notes containing numerous criticisms. One got here from Northland, which expressed shock at Intel’s obvious unpreparedness for the disappointing earnings report.

Intel ought to have introduced second quarter outcomes prematurely, says Northland analyst

At the very least seven Wall Avenue analysts who cowl the semiconductor trade lower Intel’s inventory value the day after the second-quarter 2022 earnings report was launched. The bottom of these got here from Rosenblatt, who lower his value goal from $10 to $30, referred to as the earnings “an absolute catastrophe” and likewise questioned why the outcomes weren’t introduced forward of time. The analyst additionally warned that Intel’s information heart market will undergo for years.

The second-lowest value goal got here from analysis agency Susquehanna, which lower it to $33 from $40 and mentioned that regardless of eager to consider the earnings report was a one-time occasion, there are lingering points with Intel’s enterprise mannequin which can be price watching out for for years. come. These embody the rising recognition of Arm-based information heart processors, AMD’s fast rise within the private computing house, and heavy capital spending that may proceed to cut back backside line income amid dangers of recession which contract the non-public computing market.

Northland analyst Gus Richard has the best value goal for the corporate in our pattern at the moment, as he lower it from a earlier $62 to a extra modest $55. Nonetheless, in his feedback, Richard took the corporate to job, saying the earnings report was inexcusable. The analyst added that the unforgivable earnings report calls into query the corporate’s capacity to handle its investor relations and reveals that Intel could not have the power to foretell its outcomes prematurely. because it didn’t announce the earnings prematurely.

Nonetheless, Richard maintained a tone of average optimism for the corporate, as he mentioned he expects the second and third quarters to be the worst for Intel and that the outcomes won’t be stunning given the historic turnaround that the corporate is trying.

Jefferies joined the refrain, which established a baseline situation that Intel would lose market share to NVIDIA and AMD within the PC, server and information heart markets. For advantages, the analysis agency famous {that a} fabless mannequin, course of know-how execution, and potential poor AMD execution can breathe new life into the corporate. In the long run, Jefferies identified that the rising transfer to Arm is a major risk to Intel, and that in his view, one of the best long-term technique for Intel will probably be to maneuver to a fabless mannequin by way of a three way partnership with Taiwan. Semiconductor Manufacturing. Firm (TSMC). In such a situation, Intel could be in one of the best place to share capital expenditures with the US authorities and TSMC, in addition to supply joint foundry companies.

#Intels #inexcusable #earnings #present #predict #outcomes #analyst