Apple (AAPL) – Get the Apple Inc. turns heads and provides the bulls one thing to cheer about on Friday. With shares up “simply” 3.3% to date on the day, it was a wink the bulls wanted.

Amazon (AMZN) – Get the report from Amazon.com Inc. could get all the eye with its shares up 11% in a post-earnings celebration, however Apple inventory can also be increased after a better-than-expected quarter.

Buyers fearful about potential provide chain points and fears of a recession affecting gross sales. Seems that wasn’t an issue.

Apple noticed a better and decrease tempo and whereas administration did not present steering for the subsequent quarter, the corporate mentioned income is predicted to speed up year-over-year.

That is apparently ok for traders, as Apple shares assemble their fourth consecutive weekly rally and are abruptly 25% increased from the June low.

With constructive suggestions from FAANG this earnings season – aside from Meta (META) – Get the report from Meta Platforms Inc. – the bulls acquired a key aspect for the bullish momentum. Now the query is, can it’s maintained?

Buying and selling Apple shares after earnings

Scroll to proceed

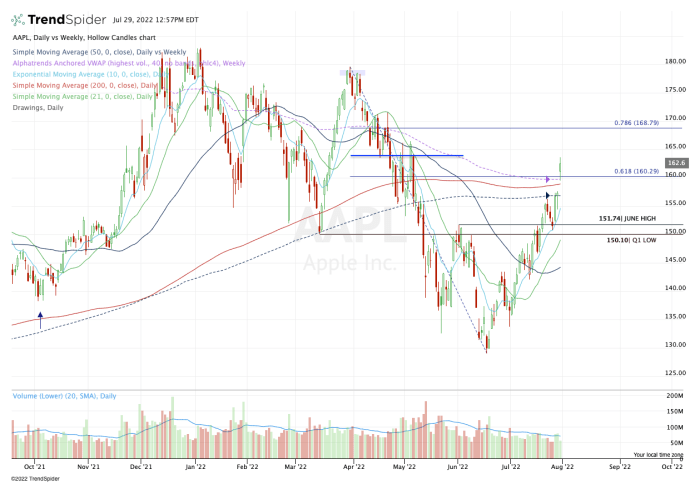

Discover how Apple inventory has risen over the previous month. Shares simply broke by way of the important thing $150-$152 zone earlier this month, which was the earlier month’s excessive and the primary quarter’s low.

After crossing this zone, Apple inventory hit the 50-week shifting common, returned to that aforementioned $150-$152 zone, and located assist. This was a key improvement for the bulls, as it will have been simple for Apple to crash and drop.

As an alternative, it rose earlier than earnings and we are actually seeing extra comply with by way of as shares transfer above the 200-day shifting common, the 61.8% retracement and the weekly VWAP measure.

All of that is very spectacular worth motion. Clearing all these metrics does not imply Apple cannot again down, however the good thing about the doubt now rests with the bull case.

If the inventory had been to lose a few of these metrics – just like the 200-day and 50-week shifting averages, the weekly VWAP metric, and the short-term energetic assist by way of the 10-week shifting common – then the bears can exploit the momentum.

Till that occurs, we now have to imagine consumers are in management. If Apple can clear the $164-$166 zone, it opens the door for the 78.6% retracement close to $169.

A transfer above that can technically carry again into play resistance at $175-$178. Given the present funding setting, it is exhausting to think about proper now. Nonetheless, it’s doable if the bulls hold management.

As for assist, the bulls want to see the $158-$160 space maintain again.

#Heres #Apple #inventory #rally #earnings