The next is an excerpt from a current version of Bitcoin Journal Professional, Bitcoin journal premium markets publication. To be among the many first to obtain this info and different on-chain bitcoin market evaluation straight to your inbox, Subscribe now.

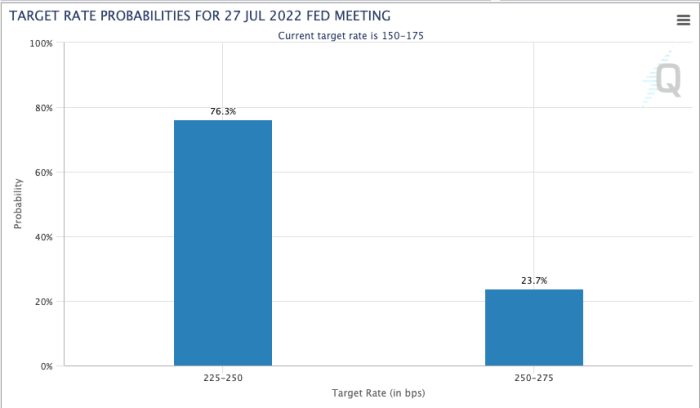

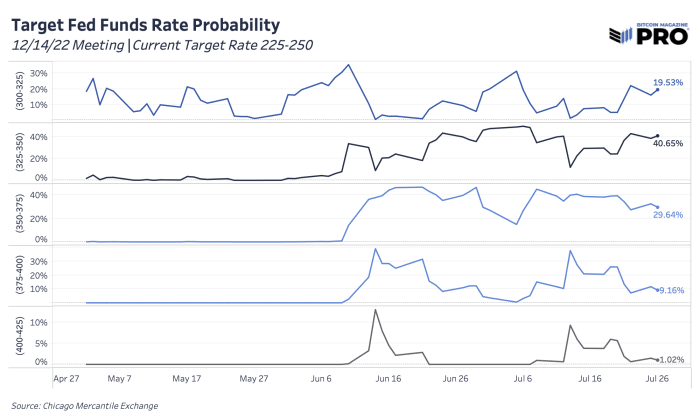

On July 27, 2022, the Federal Reserve carried out one other price hike of 75 foundation factors. This was broadly anticipated at first of the assembly, with the market attributing a 76.3% probability of a 75bp hike an hour earlier than the assembly, with a (beforehand) 23.7% probability of a price hike. 100 bps (1.0%). sq.. After the assembly and the press convention, the most recent market information places probably the most favorable odds on 100 foundation factors of hike remaining to be made by the top of the yr, on three different conferences of the FOMC.

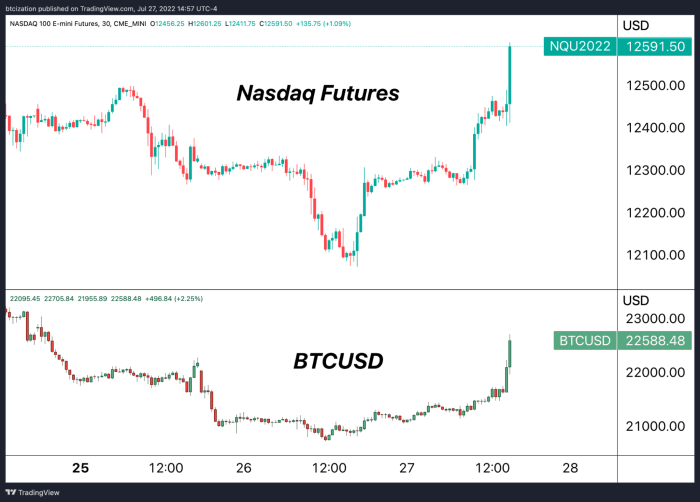

In the beginning of at the moment’s assembly, property resembling shares and bitcoin superior in tandem, because the expectation of a dovish and impartial Fed from earlier conferences elevated traders’ urge for food for threat. .

Again to the FOMC assembly and Powell’s feedback. Listed here are a number of the most notable feedback all through the press convention:

- “The labor market is extraordinarily tight, inflation is approach too excessive.”

- “We predict we want a interval of development under potential to create some looseness.”

- “We do not assume we have to have a recession.”

- “Our considering is that we need to attain a reasonably restrictive stage by the top of this yr…meaning 3% to three.5%.”

- “It’s doubtless that the total impact of the speed will increase has but to be felt.”

- “The Fed wouldn’t hesitate to take an even bigger step [rate hikes] if vital.”

- “We’re on the lookout for compelling proof that inflation will decline over the following few months.”

- “The tempo of price will increase will rely on the info.”

- “It’s essential to have a slowdown in development.”

- “We predict we want a interval of development under potential to create some looseness [in the labor market].”

- “I do not assume america is at the moment in a recession.”

- “Nobody can make sure that we are able to obtain a comfortable touchdown.”

Powell’s feedback that had been significantly notable had been the abandonment of ahead steerage from the Fed within the type of future price hikes, which is a change from earlier Fed conferences. This motion offers the Fed the flexibleness to pivot if wanted sooner or later, which was clearly a optimistic signal for the short-term markets.

Wanting past at the moment’s assembly, the previous adage of “Do not battle the Fed” nonetheless holds true, and regardless of the extra bullish final result chosen at the moment (a 75 foundation level hike fairly than a of 100 foundation factors), the end result as a result of monetary market situations are nonetheless marked by a pointy tightening, which can in all probability take a while to be felt within the markets.

Lengthy-term traders and extra lively threat managers would do higher to evaluate the chance of a historic low being in place for the fairness and crypto markets, or fairly if it’s a new one. bear market rally.

In a earlier article, “Watch out for Bear Market Rallies,” we lined the dynamics of bear market rallies in each inventory markets and bitcoin to supply subscribers with historic context.

For readers all in favour of studying extra concerning the state of the markets and the worldwide financial outlook, our upcoming July month-to-month report will present rather more detailed info on the interaction between geopolitics, financial coverage and monetary markets. The report shall be launched to paying subscribers the next Monday.

Use the banner advert above to get 25% off a Bitcoin Journal Professional subscription and be among the many first to learn the July month-to-month report or subscribe to the free model under.

#Bitcoin #Rips #Greater #Federal #Reserve #Charge #Hike