Twitter Inc. reviewed the footprint of its giant San Francisco workplace on Wednesday in preparation for downsizing and canceled the opening of an workplace in Oakland, Calif., an individual with direct data of the corporate stated. ‘affair.

The transfer clouds the way forward for the social media web site’s glossy San Francisco headquarters, a 1.1 million sq. foot trophy workplace complicated at 1355 Market Avenue, the place Twitter TWTR,

+1.30%

occupies about 75% of the house, in response to knowledge from Trepp.

The tech giants’ finances cuts may have painful ramifications for San Francisco, a metropolis with a skyline and tradition radically reshaped in current a long time by a tech growth by itself turf, but in addition by staggering inequality. and a homelessness disaster aggravated by the pandemic.

Twitter stated in an announcement Wednesday that it was “evaluating our portfolio of places of work all over the world and scaling sure places primarily based on utilization,” but in addition that its choice had “no influence on our present headcount or worker roles.

Workplaces in Seoul; Wellington, New Zealand; Osaka; Madrid; Hamburg; Sydney; and Utrecht, within the Netherlands, had been underneath assessment for closing when leases expired, an individual with data of the matter stated. The plan can be to scale places of work in Tokyo, Mumbai, New Delhi, Dublin, New York and San Francisco, however scrap plans for a downtown Oakland outpost solely.

Twitter fought Elon Musk in court docket after the Tesla Inc. TSLA,

+6.17%

The chief government has knowledgeable the corporate that he’s ending its $44 billion deal to accumulate it, after elevating the problem of bots and spam on the platform.

A cloud of 9 billion {dollars}

Past Twitter’s headquarters, lenders have financed some $9 billion price of San Francisco workplace buildings lately by promoting business mortgage bonds to traders, in response to a tally by Trepp.

As soon as thought-about a comparatively secure actual property wager, particularly high-profile properties, workplace buildings have just lately been a supply of acute concern for landlords and financiers as a result of rise of hybrid working.

“There are a variety of tech firms working San Francisco that are not coming again, or coming again the identical means,” stated Dan McNamara, founding father of the distress-focused hedge fund Polpo Capital, an actual property debt investor.

“San Francisco is sort of a whole break for us,” he stated by cellphone.

Whereas extra employees have flocked to places of work in comparison with pandemic lows, San Francisco nonetheless lags different main US cities with an occupancy fee of 38.1% as of July 25, in comparison with a nationwide common of 44.7%, in response to Kastle System’s return to work barometer in 10 cities. .

“It is simply one thing unimaginable two or three years in the past,” McNamara stated of the low occupancy ranges. Earlier than founding PolPo, he made headlines at MP Securitized Credit score Companions for conducting profitable bets towards failing malls.

A must rethink?

The pandemic and its far-reaching repercussions weren’t on the radar 10 years in the past, when the oldest loans in ongoing business mortgage bond offers would have been underwritten.

The carnage of high-flying know-how shares COMP,

+4.06%

SPX,

+2.62%

within the first half of 2022 made issues worse, drying up M&A exercise and the IPO market, but in addition driving price cuts and cutbacks for a lot of tech firms that inhabit the San Francisco Bay Space .

Twitter shares rose 1.3% on Wednesday, however had been 41.7% decrease than a 12 months in the past, in response to FactSet.

See: It is the tip of ‘fantasyland’ for Large Tech and its employees

Daniel Herzstein, director of public coverage on the San Francisco Chamber of Commerce, stated extra vacationers, commuters and officers have returned up to now two months. However he additionally stated San Francisco wanted to arrange for a brand new path ahead.

“The pandemic has essentially modified how we use places of work, and we have to rethink how we view our economic system, particularly in downtown San Francisco,” he stated by cellphone.

Workplaces a forbidden zone for lenders?

San Francisco has its personal set of challenges, however discovering lenders keen to wager massive on getting paid off 10 years in a while an workplace constructing has gotten more durable nearly in all places.

The dearth of a clearer image of the workplace’s future has made it “very tough, if not inconceivable, to finance an workplace constructing,” stated Robert Verrone, founding father of Ironhound Administration Firm, a restructuring agency actual property in New York. “Most lenders do not wish to do something.”

Previous to exercises, Verrone labored on Wall Avenue originating giant loans on business properties for practically 20 years. He hasn’t but been requested to assist kind out workplace constructing debt in San Francisco through the pandemic, however he has labored on retail within the metropolis.

San Francisco, already reeling from distant and relocated workplace employees, suffered a $400 million drop in tax income final 12 months, in response to town comptroller’s workplace.

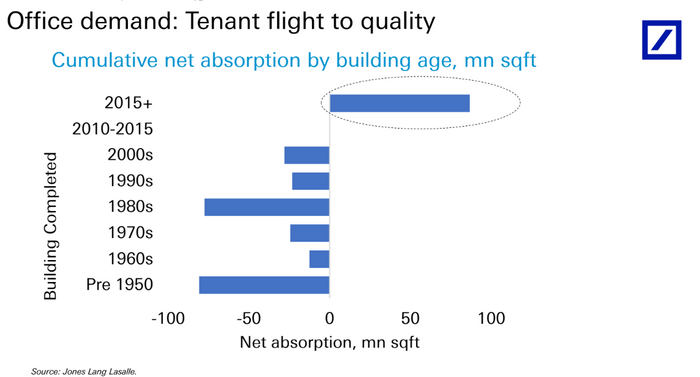

Whereas many traders anticipate extra ache for the workplace sector if tech firms downsize, the ache for older workplace buildings falling out of favor pre-COVID could possibly be worse.

Tenants have fled rundown buildings for newer ones constructed since 2015 (see chart), the one class to buck the development of unfavorable web absorption, or vacant house, in response to Deutsche Financial institution.

Tenants fleeing outdated buildings.

Deutsche Financial institution, Jones Lang LaSalle

Mortgage maturity looms

Borrower Shorenstein Properties, an actual property developer, owes $400 million on a senior mortgage to Twitter headquarters in San Francisco, in response to Trepp, a platform specializing in monitoring business mortgage bond transactions.

A June replace stated the borrower stayed present, however sought refinancing earlier than the mortgage matured in September. Shorenstein didn’t instantly reply to a request for remark.

#Twitter #rethinks #footprint #San #Francisco #greater #billion #query #looms #citys #workplace #market